The global optical transmission market returned to growth in the second quarter of 2025, posting a 9% year-over-year increase and reaching $3.8 billion in revenue.

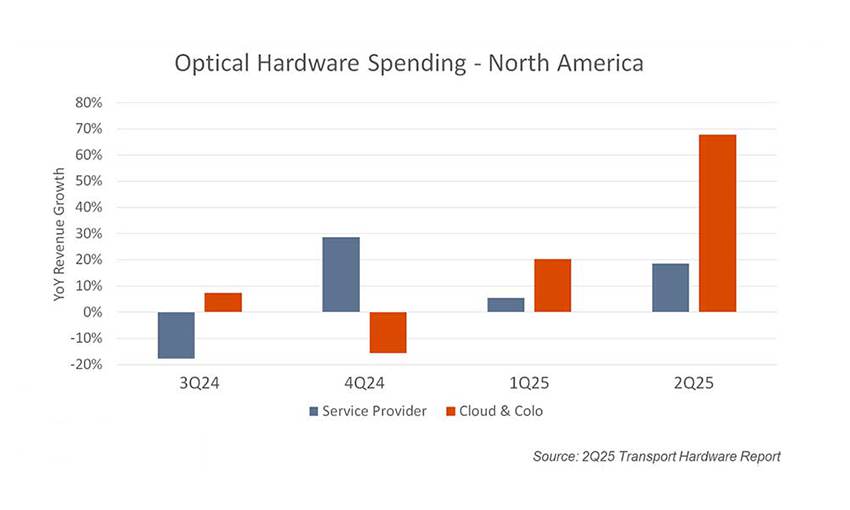

Hyperscale data center operators were almost single-handedly responsible for pulling the optical transmission market out of its 2024 slump. Cloud operator spending hit a record high, while the growth among service providers stemmed from robust demand for leased fiber network capacity to meet AI-related connectivity needs.

Artificial intelligence, particularly the construction of long-distance AI clusters, is the core driver of this market growth. To meet the demands of AI workloads, hyperscale cloud providers have begun investing heavily in building long-haul optical network backbones.

Cloud services and data center operators (Cloud & Colo) are the undisputed primary force behind this growth cycle. They have not only seen a surge in direct procurement of optical transmission equipment but have also leased substantial bandwidth capacity from service providers.

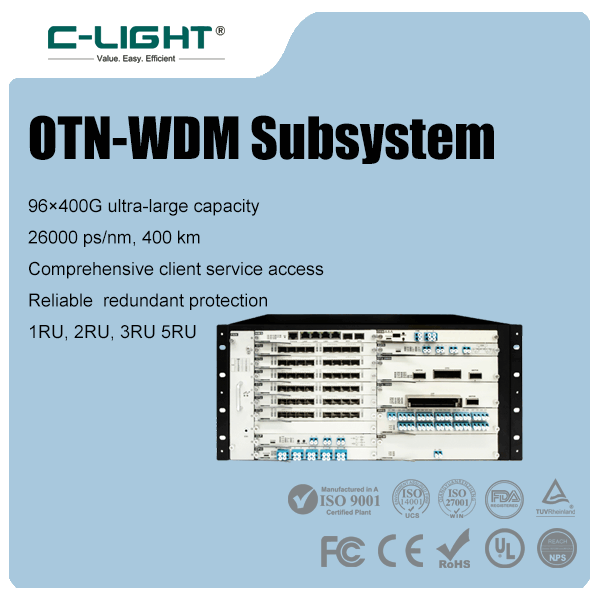

Demand for Disaggregated Wavelength Division Multiplexing (Disaggregated WDM) systems has risen sharply due to their open and flexible nature, growing at a rate far exceeding the market average. Concurrently, shipments of pluggable optical modules like 400G ZR/ZR+, used for Data Center Interconnect (DCI), also experienced rapid growth.

Excluding the Chinese market, global optical transmission sales grew 15% year-over-year. This was primarily fueled by a surge in spending from cloud and colocation operators to nearly $1 billion. Simultaneously, communication service providers resumed procurement after a prolonged period of inventory digestion.

Cloud and colocation operators now account for one-fifth of all direct optical transmission expenditure. This figure still does not include the substantial capacity they either build themselves or lease from service providers.

Spending on metro WDM remains at a historically low proportion of the market. This is due to the substitution effect of IP-over-DWDM (IPoDWDM) pluggable modules deployed in routers replacing traditional optical transport equipment. It is estimated that this shift redirects approximately $20 billion in market value annually.

North American operators accelerated their purchase orders, resulting in a positive book-to-bill ratio for most manufacturers in the quarter. Despite ongoing uncertainty regarding tariff policies and rising costs for some manufacturers, suppliers and customers have not yet adjusted pricing or order strategies in response.

TEL:+86 158 1857 3751

TEL:+86 158 1857 3751

>

>

>

>

>

>

>

>

>

>

>

>