From 2016 to 2021, the size of the global optical module market has increased year by year, with an average annual growth rate of 9%. With the increase in global data volume, optical modules are moving towards ultra-high data, and the global optical module market continues to increase in size. It is expected that the global optical module market will exceed US$15 billion by 2024 with frequency, ultra-high speed, and ultra-large capacity.

In the telecommunications market, driven by the construction of 5G networks in 2020, the telecommunications optical module market may fully recover. In 2020, the global optical network application optical module market size is expected to reach 790 million US dollars, an increase of 92.83% year-on-year. China's network construction will be the main driving force. We estimate that China's total demand for 5G fronthaul optical modules will be about 10.08 million units in 2020 (about 3 million units in 2019), corresponding to a market size of 3.49 billion yuan.

In the data center market, the inventory of downstream customers has come to an end. As capital expenditures pick up, Datacom’s 100G market is recovering, and 400G commercialization is expected to continue to make breakthroughs in 2020. Combined with our industry chain research and calculations, we expect that global shipments of 100G optical modules will increase by 25% year-on-year in 2020, corresponding to 8.75 million units, and the price drop is expected to be 10%-15% (the average price of 100G in 2019 is about 150 US dollars) The shipment of 400G optical modules is expected to be 500,000-800,000, and the price is expected to be around 600 US dollars.

Telecommunications optical module market: Benefiting from the construction of 5G commercial networks, the prosperity has improved significantly

The scale construction of China's 5G network will start in 2020, driving the telecom optical module market to improve significantly. We estimate that in the 5G construction cycle (2019-2025), the total demand for 5G fronthaul optical modules in my country will be 61.45 million, corresponding to a market size of 25.4 billion.

The data of "China's Optical Module Industry Market Operating Trends and Future Development Prospects Report 2020-2026 " released by Zhiyan Consulting shows that we expect 2020-2022 to be the stage for the improvement of the industry's business climate. (The number of base stations) increases. ASP will reach its peak in 2021 due to different networking methods (the proportion of C-RAN gradually increases in the later stage of network construction). Therefore, we expect that 2020-2021 will be the best investment window for the telecommunications optical module market. The industry will see the largest growth rate in 2020 (+285%). Although the industry growth rate will slow down (+68%) in 2021, ASP will increase. Combining the above judgments, for 2020, we pay more attention to the real demand of the industry and the release of manufacturers' production capacity; for 2021, based on the production capacity guarantee, we pay more attention to the manufacturer's product structure, that is, relatively high-end products (CWDM optical modules, middle back) Light transmission module).

Application scenarios and available optical fiber resources are the main factors that affect the fronthaul solution. The 5G fronthaul networking method determines the type of optical module. Typical application scenarios for 5G fronthaul include: 1) Direct fiber connection; 2) Passive WDM (fixed wavelength colored light, tunable wavelength); 3) Active WDM. At the end of 2019, China Mobile proposed the MWDM solution and actively promoted its commercial use. From the perspective of the consumption of optical fiber resources, the direct connection mode consumes optical fiber resources relatively.

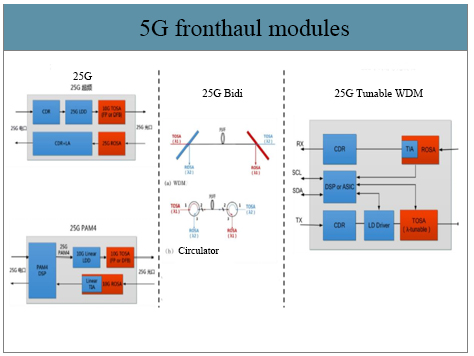

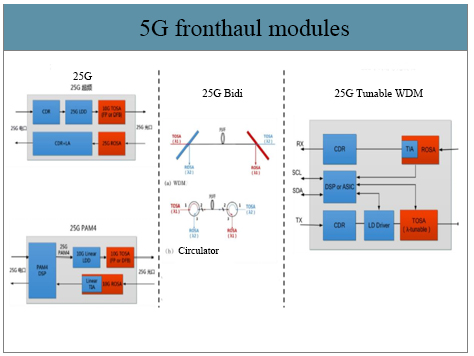

The three types of fronthaul optical modules have different maturities in the industry chain. For different fronthaul solutions, it corresponds to different types of fronthaul optical modules. There are roughly three types: 25G dual-fiber bidirectional gray-light module (which can be divided into 10G products and 25G products according to the different laser chip rates. Among them, 10G products are divided into two categories. One type is an overclocking solution, which uses an external chip to achieve 25G transmission. Rate, another type is the 25GPAM4 solution), 25G single-fiber bidirectional gray-light module, 25G tunable color light module.

5G fronthaul main optical module types and comparison

Data source: public data collation

Datacom optical module market: 100G recovery, 400G demand continues to show

2020 will be the turning point of the global Ethernet optical module market, and the industry is expected to return to a stage of high growth. We believe that the recovery of 100G and the release of 400G application demand will become the main driving force for the growth of the industry.

At present, the optical modules in the data communication market are mainly 100G optical modules. By 2022, 100G optical modules will still occupy the mainstream. At the same time, the demand for 400G optical modules will be reflected in 2019, and then the penetration rate will gradually increase. It is expected that the penetration rates of 400G optical modules from 2020 to 2022 will be 14.25%, 32.26%, and 41.60%, respectively.

For 100G Datacom products, CWDM4 has become the mainstream, and the price reduction has narrowed. Among Datacom's 100G products, we believe that CWDM4 will become the mainstream product and the penetration rate will be further improved. It is expected that the proportion of CWDM4 will increase from 40.2% to 47.6% from 2018 to 2020. In terms of price, the price of 100G digital optical modules will continue to decline to a certain extent. It is expected that the price will drop by 14% in 2020.

In terms of 400G data communication products, although it has been deployed in 19 years, it will gradually increase its volume in 2020. The 400G optical module is the next-generation evolution path of the industry. The market size of the 400G optical module is expected to be close to US$3 billion by 2023. From the perspective of industry progress, in 2019, ISP manufacturers represented by Google began to test and apply 400G systems in a small scale.

At present, 400G products are mainly used in application scenarios with transmission distances of 500m-2000m, and this part mainly corresponds to the interconnection between switches. The optical module is one of the core components of the switch. Looking back at the commercial mass production process of the 100G optical module, we believe that the volume of the 400G optical module may wait until the core components of the entire switch (such as 400G switching chips) can be commercialized (cost reduced to a reasonable Interval).

The relationship between the timing of 40G and 100G optical modules and the timing of the first release of Broadcom 40G and 100G switching chips. It can be seen that it will take 2-3 years from the introduction of Broadcom's new generation of switching chips to the corresponding rate of optical modules to begin to release. In December 2017, Broadcom released the Tomahawk3 chip, which has 12.8Tbps processing capacity and can support up to 32x400GbE ports. Based on the linear recursion of the mass production law of 40G and 100G, we expect that 400G optical modules will gradually begin to ramp up in 2020.

C-light provides optical transceiver modules of 25G, 100G, 400G and other transmission rate. C-light will keep researching and developing in the field of manufacturing optical communication equipment to improve people’s life.

Your current position:

Your current position: